What is Consumer Crypto?

Consumer Crypto is cryptocurrencies final frontier.

Last month, we launched www.igloo.inc and followed it with the news of our acquisition of Frame to build Abstract—an L2 focused on scaling and solving the challenges related to consumer crypto. Since then, it feels like the narrative has shifted toward consumer crypto, sparking debates on what consumer crypto really means. In this article, I want to discuss what I believe consumer crypto is, why we have yet to achieve consumer crypto adoption, and why I believe consumer crypto represents this industry’s final frontier.

What is consumer crypto?

I define consumer crypto as the adoption of blockchain-powered applications that serve billions of people in their everyday lives for personal use.

However, that definition is broad, so to add specificity, it's important to note that I believe consumer crypto adoption will occur in three phases. I’ve categorized each phase according to spending habits:

Phase 1: Discretionary spending

Phase 2: Necessary spending

Phase 3: Essential spending

This graph represents each phase paired with user adoption growth:

Discretionary Spending - The First 50 Million Users

The initial phase of the consumer crypto revolution will be centered around discretionary spending — consumer-focused businesses built around discretionary or leisure spending, or in other words, applications that occupy a person’s free time. These types of applications will be the first to break through because they are more prone to virality, easier to sell to consumers, and building them onchain solves problems that Web2 applications cannot address.

Businesses focused on discretionary spending tend to align around fun. In the consumer world, "fun" often faces significant barriers to entry such as payment processor issues, geo-restrictions, and rules that prevent internet businesses from scaling and thriving. To illustrate this, let’s identify some current issues facing consumer-focused, Web2 businesses:

Fees: Typical payment processor fees are too expensive and hold too much leverage over merchants. On average, merchants are charged 2.9% to 10% on transactions. The higher the risk profile (which is often the case with fun applications), the higher the fees.

Geo-restrictions: Doing business in your native country is straightforward, but expanding globally presents significant challenges, especially in navigating compliance across various jurisdictions. Most applications are not scalable outside of their current jurisdiction. Fun is universal, but Web2 infrastructure is unfortunately not.

Chargeback risk. Current Web2 applications are handicapped by size of spend. Businesses do not always capture the true potential of their power users because of the limits that processors put to prevent people from spending the amounts that they want to spend.

Censorship: Businesses face the risk of censorship from service providers, which can prevent them from scaling aggressively or reaching their full potential.

Building consumer applications around discretionary spending presents the lowest-hanging fruit within the consumer crypto ecosystem and will be the first phase to break through to mass adoption because entrepreneurs building fun products are simply going to have an easier time building them on blockchain rails. To provide more clarity, these are the consumer categories within discretionary spending that I believe are most ripe for disruption:

Gaming

Social (Creator platforms)

Trading

Casinos

Betting

Digital collectibles

Tokenized culture: Turning the intangible into tangible, tradable, exchangeable, and permanent assets.

I believe these categories have the potential to drive consumer adoption to its first 50 million active users. To support this thesis, below is a list of the most important consumer crypto applications we’ve seen today. Notably, all of them fall into the category of businesses that target capturing a share of discretionary spending:

OpenSea - Digital collectibles

Topshot - Digital collectibles

Polymarket - Betting

pump.fun - Social and tokenized culture

Uniswap - Trading

Rollbit - Casino

Pudgy Penguins - Digital collectibles

StepN - Social

Axie - Gaming

Necessary Spending - The Road to 250 Million Users

Once you break through to your first 50 million users, the focus expands into capturing a share of necessary spending—integrating crypto into more aspects of life beyond free time. This phase consists of applications in the following categories:

DeFi

DePin

SaaS

Digital Media

Digital Commerce

Payments

Essential Spending - A World Onchain

After overcoming the necessary spending barrier, we reach breakthrough adoption—the adoption of essential spending. This is when consumer applications are built around essentials, enabling users to do anything and everything onchain that they could otherwise do offchain. Examples include:

Online Banking

Credit

Tokenization (RWAs)

Insurance

Data

IoT

Identity

Voting

So now that the path to success is clear, why haven’t we already achieved mass adoption, and how do we get there?

The Problem: Why haven’t we had breakthrough user adoption?

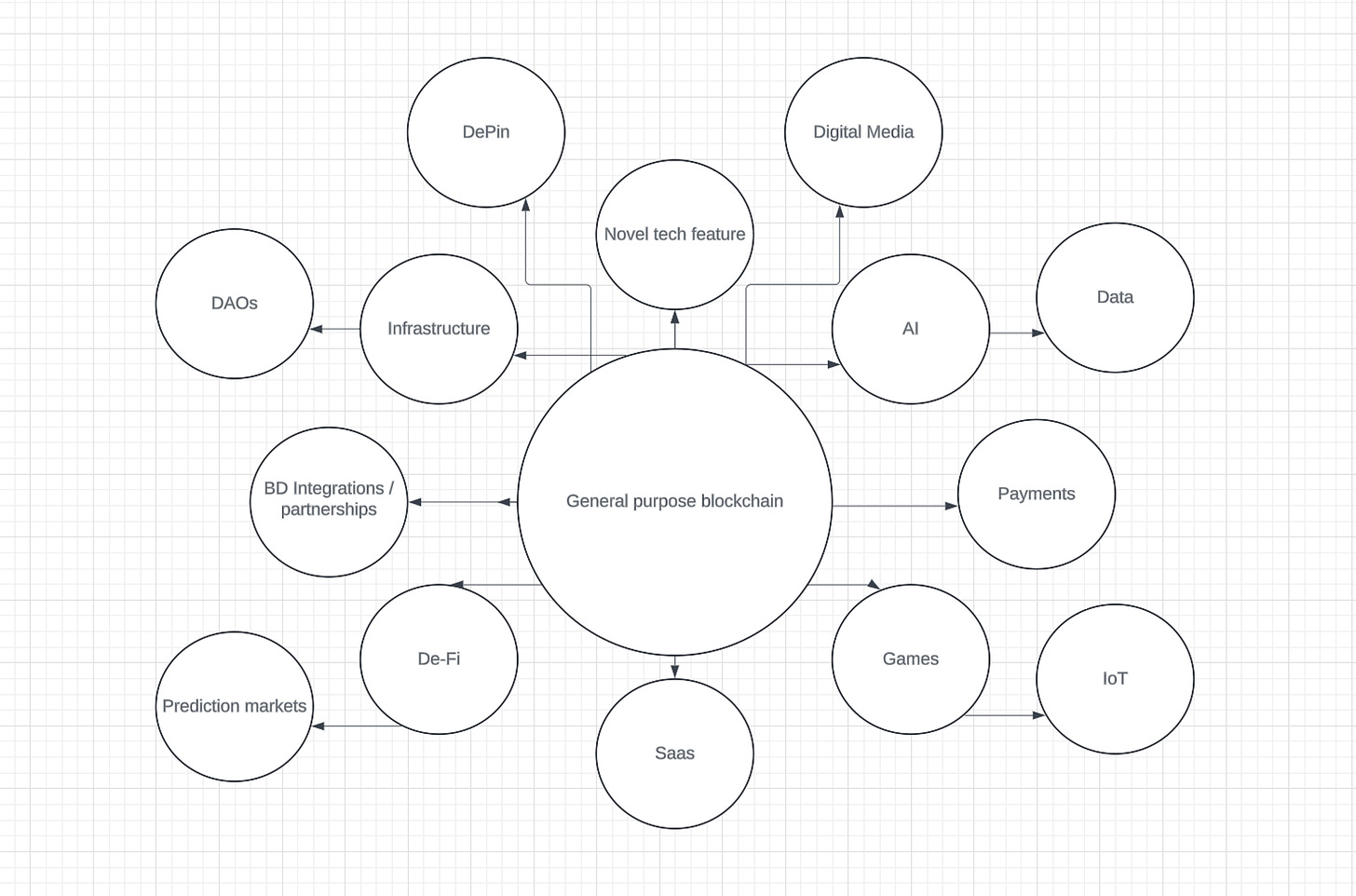

Over the last 10 years, the custody of consumer adoption has been in the hands of chains that raised tens of billions of dollars to push adoption further. Unfortunately, few have been successful in this approach and my answer to why is simply rooted in the ethos in which they build. My assessment is that many blockchain companies today follow a 0-100 "general purpose" approach, with ambitious dreams of becoming the rails for the next generation of the internet economy. Below is a visualization of how general-purpose blockchains go about their growth and priorities.

General-purpose blockchains:

The general-purpose model shows a classic case of fragmentation and unfortunately for us, mass market penetration and fragmentation are not parallel. The general-purpose approach is ambitious, but the lift required to achieve it is immense. As a result, teams without the necessary talent or resources to pursue this approach face a high likelihood of going out of business sooner rather than later, ultimately wasting time, energy, and resources that otherwise would have been invested in achieving mass adoption.

The Solution: Aligning the focus is necessary to break through to mass.

I believe blockchains are like cities, and like all cities, demand for them is driven by the attractions and activities they offer. For this reason, I believe that the breakthrough for consumer adoption will come from teams hyper-focusing on curating premier attractions within their city. Once you have an attraction that is driving people into your ecosystem, you can then build the city around that attraction.

Consumer-specific blockchain:

My assessment based on the above context is that we haven’t broken into mass adoption not because we can’t, but because we haven’t focused on doing it properly. General-purpose blockchains and consumer-focused blockchains are not interchangeable. Building the 'Consumer Chain' isn't just a catchy tagline—it's a fundamental objective and mindset that no one has fully embraced. Recognizing this gap, we saw a unique opportunity in the blockchain space, which led Igloo to acquire the Frame team to contribute to building Abstract.

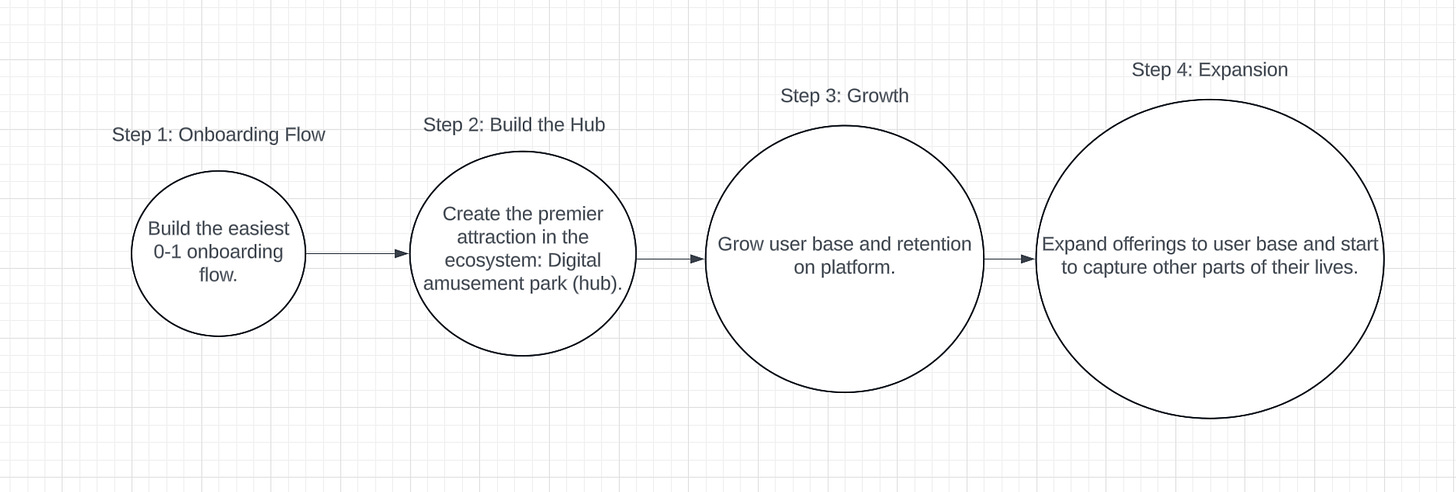

Our team's commitment is to create a premier destination on the chain, a place designed to be the most fun destination on the internet—what I call 'crypto’s digital amusement park' or 'the internet’s Disneyland.' The graphic below highlights our unwavering focus on delivering an exceptional 0-1 consumer experience without distractions. Over time, we could evolve into a general-purpose chain once we’ve built a loyal user base by introducing new offerings that capture other aspects of people's lives. To us, this represents a highly focused strategy based on achieving concrete success and then growing, compared to the fragmented approach taken by general-purpose chains.

Abstract’s path to success:

Consumer Crypto is Crypto's final and most important frontier

Crypto today mirrors the early 2000's internet boom. In the first decade of that era, innovative infrastructure companies emerged, but few gained widespread adoption. Over time, only those that managed to achieve breakthrough adoption survived and thrived. Crypto is now at a similar crossroads. After 10 years of building foundational infrastructure, it’s time for the industry to break through to the mainstream.

However, the narrative around crypto is fragile. Currently, the space is dangerously veering towards a reputation as a haven for gambling and financially risky behavior. As more people experience losses, the perception of crypto as a scam for degenerate gamblers solidifies in the public consciousness. While this may be a meme to crypto natives, it’s a very real concern for the general public and, unfortunately, is the current narrative around crypto. I am worried that if we don’t achieve mass adoption in a meaningful way soon, we risk capping the potential of the entire industry. This is why I believe consumer crypto represents the most critical and final frontier in crypto’s lifecycle.

Community Questions

To conclude this article I asked my X community if they had any questions around consumer crypto. Below are a couple questions from them and my respective answers.

Question 1

Answer: Tangibility:

One of the biggest unlocks of tokenization is being able to make the intangible tangible. One of crypto's greatest potential innovations may actually be its ability to impact and extract value from culture through tokenization. Let me explain: since the beginning of time, investors have always tied their investment ratios to literal value, P/E ratios, or future forecasts. It wasn’t until crypto came around did figurative value even become a thing, but even until just now, I haven’t heard anyone describe it like that. To me, a new asset class has been unlocked and a paradigm shift has happened, one where intangible pieces of culture have now become tangible. I think the biggest opportunity around tokenization is the tokenization of influence and finally being able to make influence tangible. We saw products in the past such as bitclout, friendtech, and others try to crack this code. However, I don’t think any of them got it close to right. In my mind, there's a pump.fun meets Bitclout, meets Polymarket, meets an Instagram-style product that could be one of crypto's most valuable companies.

Question 2:

Answer: Don’t reinvent the wheel (yet)

Crypto builders try too hard to reinvent the wheel. There’s breakthrough consumer products today that could be 10x as big as they are, leveraging crypto rails and incentives. Rather than trying to reinvent a paradigm, take an existing one and crypto-fi it. I think there’s a slew of consumer crypto apps that have yet to be made that have Web2 counterparts waiting to unlock huge amounts of growth potential via crypto rails.

Gud stuff